This article first appeared in The Edge Financial Daily, on May 18, 2016.

Triplc Bhd (-ve)

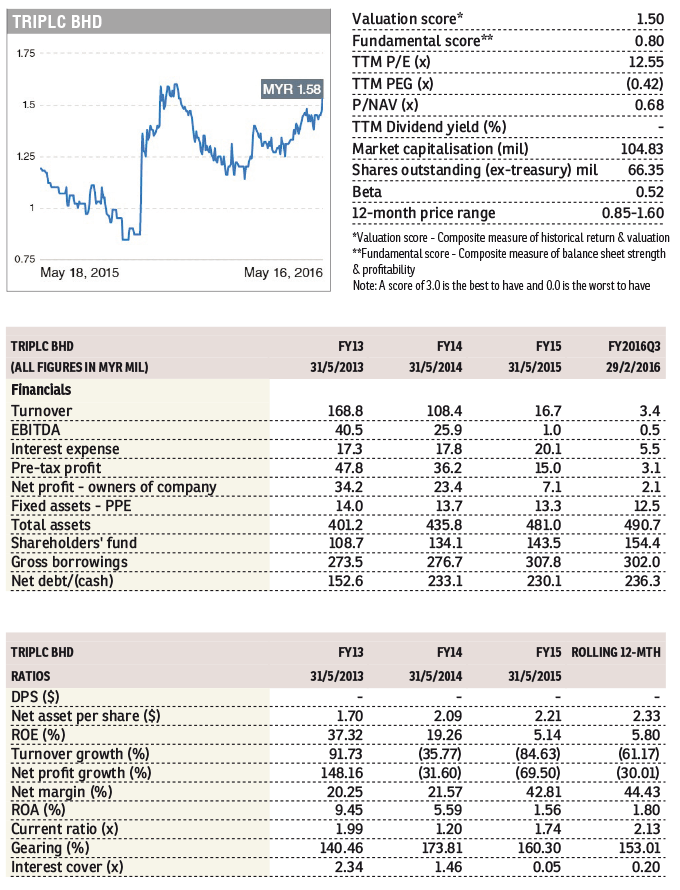

Triplc Bhd (fundamental: 0.8/3, valuation: 1.5/3) rose by 5.7% to its six-month high of RM1.67 with 1.13 million shares traded. The trading volume for the counter is relatively high as compared to its 200-day average volume of only about 62,159.

Triplc was last featured in “Stocks with Momentum” in Oct 29, 2015 with a negative momentum, and has been on the slide until Jan 14 this year when it started to pick up again. Since Jan 14, when it was at RM1.20, the stock has gradually climbed to the current level.

The group’s third financial quarter ended Feb 29, 2016 net profit increased by 75.7% even though its revenue for the quarter under review declined slightly by 0.01% to RM3.45 million, from RM3.47 million a year ago.

Currently, Triplc is trading at a trailing price-earnings ratio (PER) of 13.26 times compared to its 10-year average PER of 7.72 times. The group has a market capitalisation of RM110.8 million.

TRIPLC (5622) - Stock With Momentum: Triplc

http://www.theedgemarkets.com/en/node/279836