1. SUNCON

Sunway Construction Group Bhd

Sunway Construction Group Bhd (SunCon) is seen as the best proxy for growth in the construction sector this year underpinned by a strong infrastructure pipeline.

UOB Asset Management (Malaysia) Bhd executive director and chief executive officer Lim Suet Ling likes the stock due to its strong order book visibility with high replenishment prospects.

“SunCon is a pure contractor with no property development exposure,” Lim told The Edge Financial Daily.

In a report dated Nov 25, TA Securities noted that as at Sept 15, SunCon had an outstanding order book of RM4.3 billion, which translates into 2.3 times its financial year 2014 (FY14) revenue, and this could provide earning visibility for the next two years or until 2018.

The company is also seen as a strong contender for upcoming mega infrastructure projects such as the Light Rail Transit Line 3, the Klang Valley Mass Rapid Transit Line 2 and the Bus Rapid Transit (BRT), it added.

“The company has a very sizeable order book, and it has its parent company (Sunway Holdings Bhd) to support its business,” TA Securities head of research Kaladher Govindan said. As of Dec 28, Sunway Holdings had a 54.42% stake in SunCon.

He said SunCon is also a fully integrated construction player and thus, it is able to offer a full package of construction services.

Although investors may turn defensive under the current challenging economic conditions, Kaladher said he still sees opportunities in undervalued companies with good fundamentals and long-term growth such as SunCon.

For its cumulative nine-month period ended Sept 30, 2015, SunCon reported a net profit of RM97.82 million on revenue of RM1.45 billion, mainly due to higher profit recognition from the civil/infrastructure projects. No comparative figures were available for the preceding year’s corresponding period as SunCon was only listed on the Main Market of Bursa Malaysia on July 28 .

According to a fund manager who declined to be named, SunCon’s price-to-earnings ratio of 13 times would deem it decent to investors, and its earnings visibility is considered high compared with its peers.

“In addition, SunCon’s business is domestic-driven and thus, it is not expected to be affected significantly by external shocks,” he added.

Since it started trading at RM1.20, SunCon shares had gained 16.7%. The stock closed three sen or 2.19% higher at RM1.40 last Thursday, bringing its market capitalisation to RM1.81 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-sunway-construction-group

2. INARI

Inari Amertron Bhd

Inari Amertron Bhd’s rosy days are expected to continue into this year on the back of capacity and production expansion, coupled with growth expected in the global semiconductor industry.

TA Securities technology analyst Paul Yap said the company’s earnings in 2016 are expected to be driven by both the weaker ringgit and ramp-up of testers at its P13 facility in Bayan Lepas, Penang.

“The short-term and long-term prospects for the company are good,” Yap said. “It is already in discussion to expand its P13 facility, termed P13B, to support its next wave of growth in its radio frequency (RF) business.”

He said the expansion of the P13 facility will see the company boosting the number of testers to 800 by October this year from 609 testers in October last year.

Yap also said Inari could also gain potential opportunities from the merger between Avago Technologies Ltd — Inari’s principal client — and Broadcom Corp. Inari’s other client, Germany-based Osram Licht AG also plans to build a light emitting diode chip plant in Kulim, Kedah.

“The group (Inari) may potentially benefit from this due to the existing relationships with both companies (Avago and Osram),” he added.

For the financial year ended June 30, 2015 (FY15), Inari’s net profit climbed 40.26% to RM40.38 million from RM28.79 million in FY14, on the back of a 13.91% increase in revenue to RM255.02 million from RM223.88 million in FY14.

Yap also said the prospects for Inari’s RF business are bright as Avago is still unable to satisfy demand from Chinese long-term evolution handset original equipment manufacturers. The RF segment contributes about 50% of the group’s revenue.

CIMB Investment Bank analyst Mohd Shahnaz Noor Azam said Inari plans to increase its production floor area by another 50% to 506,000 sq ft this year from 328,000 sq ft currently, which will be supported by orders from Avago.

He likes the company due to its strong balance sheet, with a net cash position of RM206 million, which is sufficient to support Inari’s expansion drive. Inari is involved in the back-end semiconductor packaging, which comprises back-end wafer processing, package assembly and RF final testing for the semiconductor industry.

According to the World Semiconductor Trade Statistics, the global market is expected to grow at a modest pace of 1.4% in 2016, driven by forecast growth across all major products (excluding memory) and all regions (except Europe).

In one year, Inari shares had soared 90%, outperforming the FBM KLCI’s 3.97% decline. Inari shares closed 2 sen or 4.18% lower at RM4.58 last Thursday, with a market capitalisation of RM3.54 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-inari-amertron

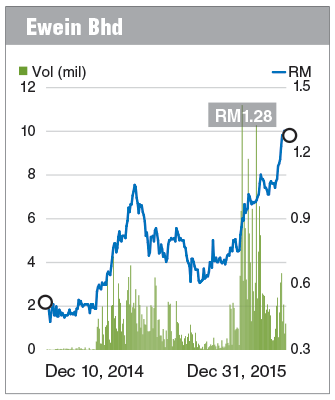

3. EWEIN

Ewein Bhd

Ewein Bhd is set to see meaningful full-year contributions from its property development project in Penang this financial year ending Dec 31, 2016 (FY16), which is expected to bolster its pre-tax profit significantly.

The Penang-based company, which was originally involved only in the manufacture of precision sheet metal fabricated parts, is jointly developing the RM800 million City of Dreams condominium project in Bandar Tanjong Pinang (BTP), Penang with Consortium Zenith BUCG Sdn Bhd, and bagged its second project on the island last week.

However, Mercury Securities head of research Edmund Tham is looking for more visibility in Ewein’s financial figures as it remains to be seen if the group can roll out its maiden property development with satisfying sales.

“If everything happens as planned, it would be positive for Ewein. But it is still early to tell now. We are waiting to see its fourth-quarter ended Dec 31, 2015 (4QFY15) results, which will be released next month (Feb 2016),” he said.

The recent announcement of its third-quarter results saw a jump in its earnings of 16 times year-on-year to RM6.42 million, mainly driven by its property development business from the City of Dreams project.

Ewein’s revenue more than doubled to RM29.21 million in 3QFY15, from RM13.43 million in 3QFY14. The strong third-quarter results pulled up its performance for the nine-month period (9MFY15), with its net profit increasing 10 times to RM7.62 million, while revenue rose 46.3% to RM49.48 million.

Notably, the group’s short-term loans and borrowings ballooned 6.7 times to RM42.82 million as at 3QFY15, from RM6.36 million last year. Nevertheless, its cash and cash equivalents also surged 75.57% to RM49.24 million for the quarter under review, from RM28.04 million as at 3QFY14.

Apart from City of Dreams, Ewein is proposing to develop three blocks of luxury serviced apartments on a 4.4252-acre (1.79ha) piece of freehold land at BTP, which will have a gross development value of RM1 billion.

Dubbed City of Dreams II, the service apartments will comprise 891 units.

In the past year, Ewein’s share price climbed 180.1% from 45.7 sen on Dec 31, 2014 to RM1.28 last Thursday, giving it a market capitalisation of RM274.8 million.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-ewein

4. SASBADI

Sasbadi Holdings Bhd

Since its listing on the Main Market of Bursa Malaysia in July 2014, it has been a busy two years for Sasbadi Holdings Bhd, with a series of announcements on collaborations and acquisitions that are intended to spur growth in the company.

For its financial year ended Aug 31, 2015 (FY15), Sasbadi reported a net profit of RM15.33 million, which was 25.1% higher than its FY14 net profit of RM12.25 million. Revenue for FY15 was also up by 9.9% to RM87.41 million from RM79.51 million, mainly from its education print publishing unit.

The group also declared a final dividend of two sen per share.

In a Dec 11, 2015 note on Sasbadi, Alliance DBS Research upgraded its rating on Sasbadi to “buy” from “hold”.

“We expect the group to deliver FY16 to FY17 earnings growth of 33% and 22% respectively, driven mainly by its conventional book publication and mergers and acquisitions (M&A) activities. Besides that, we believe positive news flow could arise from its regional collaboration and unconventional digital learning products,” said Alliance DBS Research.

On Nov 23, 2015, Sasbadi announced that it had entered into a memorandum of understanding with Southern Publishing and Media Co Ltd, one of the biggest publishing corporations in South China, to explore collaboration in intellectual property rights, digital teaching and learning resources and technology, as well as online teaching and learning platforms.

“There also exists earnings upside potential from its ongoing partnership with PT Penerbit Erlangga, one of Indonesia’s largest book publishers,” said Alliance DBS Research.

Sasbadi inked a licence and service agreement with Penerbit Erlangga in October 2014, which allows the latter to use Sasbadi’s interactive online learning system i-Learn, entitling Sasbadi to royalties from products sold by Penerbit Erlangga using the platform.

The group also announced on Aug 7, 2015 that it was acquiring a 70% stake in Sanjung Unggul Sdn Bhd for RM21 million. The Sanjung Unggul Group is principally involved in publishing books and educational materials catering for students in national-type Chinese schools.

HLIB Research in its Nov 3, 2015 note on Sasbadi said apart from M&A activities, new syllabus and organic growth, the group’s growth in FY16 could also be underpinned by full contribution from Sanjung Unggul.

“Sanjung Unggul controls about 40% to 50% of the Chinese publisher market share,” wrote HLIB Research, adding that over the next two to three years, Sasbadi is looking at acquiring at least one company per year.

In the past year, Sasbadi shares appreciated by 71.7% from RM1.45 on Dec 31, 2014 to close at RM2.49 last Thursday, ahead of the long New Year holiday weekend, with a market capitalisation of RM316.23 million.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-sasbadi-holdings

5. Bumi Armada

Bumi Armada Bhd

Despite reporting a drop in its net profit in its latest quarterly results, analysts see value in Bumi Armada Bhd (BAB), based on the offshore oilfield service provider’s upcoming delivery of its new floating production storage and offloading (FPSO) projects in the coming years.

Maybank Investment Bank Bhd said it expects a significant jump in BAB’s earnings in 2017, driven by the conversion of four FPSO vessels, namely Kraken, Eni, Madura and Malta, which are likely to be delivered in 2016 and 2017.

It is also worth noting that the company has secured a US$1.12 billion (RM4.82 billion) syndicated facility to part-finance the provision of a FPSO vessel, which is to be chartered to Eni.

“We expect a significant 3.6 times year-on-year jump in BAB’s earnings in 2017 should these projects be smoothly executed,” said the research house.

It added that the company is also bidding for two key jobs in Vietnam and Brazil to ensure sustained growth beyond 2018.

Maybank has a “buy” rating on BAB, with a target price of RM1.20.

Meanwhile, Macquarie Equities Research highlighted the stable income generation from BAB’s ongoing FPSO leases and the group’s established presence in the Caspian Sea transportation & installation segment.

“Once commissioned, an FPSO provides [a] recurring cash flow to its owner throughout the lease tenure with minimal cancellation risk. Macquarie estimates BAB’s six units of operating FPSO to underpin over 40% of its 2016 profit before tax (PBT) and 30% of 2017 PBT,” it said.

According to Bloomberg data, the counter fell 38.8% from 2015’s high of RM1.283 on June 4 to the year’s low of 78.5 sen on Aug 25. In 2015, BAB fell 5.1%, underperforming the FBM KLCI, which fell 3.44% during the same period.

BAB closed two sen or 1.92% lower at RM1.02, giving it a market capitalisation of RM6.1 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-bumi-armada

Despite reporting a drop in its net profit in its latest quarterly results, analysts see value in Bumi Armada Bhd (BAB), based on the offshore oilfield service provider’s upcoming delivery of its new floating production storage and offloading (FPSO) projects in the coming years.

Maybank Investment Bank Bhd said it expects a significant jump in BAB’s earnings in 2017, driven by the conversion of four FPSO vessels, namely Kraken, Eni, Madura and Malta, which are likely to be delivered in 2016 and 2017.

It is also worth noting that the company has secured a US$1.12 billion (RM4.82 billion) syndicated facility to part-finance the provision of a FPSO vessel, which is to be chartered to Eni.

“We expect a significant 3.6 times year-on-year jump in BAB’s earnings in 2017 should these projects be smoothly executed,” said the research house.

It added that the company is also bidding for two key jobs in Vietnam and Brazil to ensure sustained growth beyond 2018.

Maybank has a “buy” rating on BAB, with a target price of RM1.20.

Meanwhile, Macquarie Equities Research highlighted the stable income generation from BAB’s ongoing FPSO leases and the group’s established presence in the Caspian Sea transportation & installation segment.

“Once commissioned, an FPSO provides [a] recurring cash flow to its owner throughout the lease tenure with minimal cancellation risk. Macquarie estimates BAB’s six units of operating FPSO to underpin over 40% of its 2016 profit before tax (PBT) and 30% of 2017 PBT,” it said.

According to Bloomberg data, the counter fell 38.8% from 2015’s high of RM1.283 on June 4 to the year’s low of 78.5 sen on Aug 25. In 2015, BAB fell 5.1%, underperforming the FBM KLCI, which fell 3.44% during the same period.

BAB closed two sen or 1.92% lower at RM1.02, giving it a market capitalisation of RM6.1 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-bumi-armada

6. CMS

Cahya Mata Sarawak Bhd

This year, Sarawak would hold its first state election under Chief Minister Tan Sri Adenan Satem. The federal and state governments have announced infrastructure developments for Sarawak, especially the RM27 billion Pan-Borneo Highway to garner goodwill of the people.

One of the beneficiaries of the mega projects would be Cahya Mata Sarawak Bhd (CMS), which is involved in cement manufacturing, construction materials, trading, construction, road maintenance, property development, financial services, education and other services.

“In addition, CMS is the largest listed company in Sarawak and it is also a proxy,” said RHB Research Institute analyst Ng Sem Guan.

CMS is controlled by Sarawak governor Tan Sri Taib Mahmud’s family.

Ng said, post election, the valuation of CMS will revert to its fundamentals based on economic activities in the state to sustain the earnings.

RHB Research has a “buy” call on CMS with a sum-of-parts-based target price of RM5.55, offering 8% upside from last Thursday’s closing price of RM5.13.

CMS gained 29.54% in 2015 up to its closing price of RM5.31 on Dec 31, with a market capitalisation of RM5.48 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-cahya-mata-sarawak

This year, Sarawak would hold its first state election under Chief Minister Tan Sri Adenan Satem. The federal and state governments have announced infrastructure developments for Sarawak, especially the RM27 billion Pan-Borneo Highway to garner goodwill of the people.

One of the beneficiaries of the mega projects would be Cahya Mata Sarawak Bhd (CMS), which is involved in cement manufacturing, construction materials, trading, construction, road maintenance, property development, financial services, education and other services.

“In addition, CMS is the largest listed company in Sarawak and it is also a proxy,” said RHB Research Institute analyst Ng Sem Guan.

CMS is controlled by Sarawak governor Tan Sri Taib Mahmud’s family.

Ng said, post election, the valuation of CMS will revert to its fundamentals based on economic activities in the state to sustain the earnings.

RHB Research has a “buy” call on CMS with a sum-of-parts-based target price of RM5.55, offering 8% upside from last Thursday’s closing price of RM5.13.

CMS gained 29.54% in 2015 up to its closing price of RM5.31 on Dec 31, with a market capitalisation of RM5.48 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-cahya-mata-sarawak

7. TAANN

Ta Ann Holdings Bhd

Ta Ann Holdings Bhd, with its attractive dividend yield, high-growth businesses and undemanding valuation, makes it a top pick in 2016 for analysts.

UOB Asset Management (Malaysia) Bhd executive director and chief executive office Lim Suet Ling likes the Sarawak-based plantation and timber group Ta Ann because of its strong potential for growth coming from its plantation division and undemanding valuation.

Supported by the recent stabilised crude palm oil (CPO) prices, Lim believes that this would deem Ta Ann attractive for foreign funds looking for stocks that provide strong plantation exposure.

Kenanga Research plantation analyst Voon Yee Ping remains bullish on the stock into the new year due to Ta Ann’s dividend yield and high-growth businesses.

According to Voon, Ta Ann’s dividend yield of 5.9% is well above the sector’s average of 2.6%, while its price-to-earnings ratio stands at 14 times versus the peer average of 21 times.

“Ta Ann is still our ‘outperform’ top pick [for 2016],” she said.

The group on Nov 16, 2015 declared a second interim dividend of 10 sen per share for the financial year ended Dec 31, 2015 (FY15), bringing its total dividend for the year to 20 sen per share.

Most analysts noted that stronger earnings could potentially yield higher dividends for the group.

Ta Ann saw its net profit jump 54.63% year-on-year to RM67.42 million in the third quarter ended Sept 30, 2015 (3QFY15). For the cumulative nine-month period last year, it achieved a 25.4% year-on-year increase in net profit to RM127.95 million. The positive results prompted all analysts to upgrade their earnings forecast for Ta Ann in the next two years.

Voon also pointed to the regional timber supply crunch, which should provide near-term earnings upside for the group’s timber division.

“Moreover, the downside on plantation is limited as CPO prices are expected to improve in 2016,” she added.

Another plus point for Ta Ann is that it is seen as a beneficiary from a weaker ringgit this year.

In the past year, Ta Ann shares appreciated by 29.38% to close at RM5.02 last Thursday, with a market capitalisation of RM1.86 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-ta-ann-holdings

8. KAREX

Karex Bhd

Karex Bhd, the world’s largest condom manufacturer by volume, witnessed a strong start to the financial year ending June 30, 2016 (FY16) with a stellar first-quarter performance, and analysts expect the group to continue its positive momentum in 2016.

Karex reported a 74% increase in net profit for the three months ended Sept 30, 2015 to RM22.29 million from RM12.83 million a year ago, boosted by a gain in foreign exchange, sales of higher-margin products and lower raw material prices.

Revenue for the quarter rose 8% to RM76.09 million from RM70.13 million a year earlier, which Karex attributed to higher volumes from its condom commercial-sales segment.

“Investors continue to see value in Karex as it is a global fast-moving consumer goods counter that is a strong beneficiary of the weak ringgit against the US dollar,” opined a remisier with a local investment bank.

In its Dec 1, 2015 note on Karex, AffinHwang Capital said the group’s new production capacity is expected to reach 4.5 billion pieces by mid-FY16.

CIMB Research, in its Dec 1, 2015 note, said the group is on track to increase its production capacity to 4.5 billion pieces per year by December 2015 and six billion pieces by December this year.

“We are positive on the launch of Karex’s ONE brand condom in Malaysia in December 2015, as the group plans to launch it in other countries in Southeast Asia and South America in 2016.

“In addition, the management is targeting to increase its own-brand-manufacturing contribution to at least 20% over the next three to five years,” said CIMB Research.

“In terms of pricing, Karex expects to offer about 10% to 15% discount compared to Durex,” it added.

In the past one year, Karex’s share price has surged by 85% from RM2.24 on Dec 31, 2014 to RM4.13 last Thursday, with a market capitalisation of RM2.76 billion.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-karex

9. Tiong Nam

Tiong Nam Logistics Holdings Bhd

Tiong Nam Logistics Holdings Bhd saw its share price soar by as much as 38.89% in a month to hit a one-year high of RM1.50 on Nov 9, 2015, after The Edge weekly reported in early October 2015 that the Johor-based delivery and warehousing company was going to park its warehouses under a real estate investment trust (REIT).

Despite the rise in its stock, Tiong Nam was still trading at a trailing 12-month price-earnings ratio (PER) of 8.48 times last Thursday — lower than its peers, such as Harbour-Link Group Bhd, Tasco Bhd, Freight Management Holdings Bhd and Transocean Holdings Bhd, which are trading at a double-digit PER.

There are various possibilities for Tiong Nam once it conducts the REIT spin-off, which reportedly could happen in the second half of this year.

The most obvious one would be to bring down its gearing ratio. Analysts have noted that its high debt load — which came to 1.04 times its equity after deducting the cash in hand — could be a reason why it gets a lower valuation against its peers.

Regardless of whether Tiong Nam pays off its RM521.22 million borrowings with the initial public offering (IPO) proceeds or not, its gearing level will be lower with a huge cash pile boosting its shareholders’ funds. It’s only a matter of how much Tiong Nam will make from the REIT unit’s sale, where it was reported that the trust is looking at having a RM1 billion valuation.

Secondly, will Tiong Nam finally have a more comparable price-earnings valuation once its logistics business has a bigger share in the group’s profit contribution? Although Malaysia’s listed logistics have distinctive business models, they are still in the same sector.

There’s also the possibility of Tiong Nam dangling special dividends to its shareholders from the IPO proceeds. Whatever the possibilities are, the REIT spin-off is likely to bring some excitement to Tiong Nam’s counter once the details are made official.

Compared with its closing price of RM1.10 on Dec 31, 2014, Tiong Nam’s share price jumped by 24.5% to close at RM1.37 last Thursday, giving it a market capitalisation of RM570.81 million.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-tiong-nam-logistics-holdings

10. SKP Resources

SKP Resources Bhd

SKP Resources Bhd, which saw its share price double since the beginning of 2015, still offers more upside potential, analysts said, anticipating a substantial jump in the group’s earnings for the financial year ending March 31, 2016 (FY16).

The main catalyst for the plastic parts and components manufacturer is the two contract wins from UK-based Dyson Ltd, for the manufacturing of cordless vacuum cleaners. The contracts are worth a combined RM1 billion per year, over five years.

Kenanga Research analyst Desmond Chong is optimistic on the two contracts and said they are an indicator of Dyson’s confidence in SKP’s capability.

“We are comforted by these new contract announcements as it signals Dyson’s confidence in SKP’s capability, which would boost its chances of securing other contracts in the near to medium term for other products.

“Beyond that, we also understand that the group has already involved in the development phase of new products that should take up another 20% to 30% capacity in the medium term, if all goes well,” said Chong.

Moreover, he noted that SKP could benefit from Dyson’s aggressive expansion plans, after the group announced an investment of £1.5 billion (RM9.54 billion) for the development of four new product ranges, for the launching of 100 new products in the next four years.

According to Bloomberg data, SKP’s share price jumped 103.13% in the past one year, despite the dampened domestic market. During the same period, the FBM KLCI saw a decline of 1.03%.

For the first half of FY16, net profit was 80% higher at RM36.32 million, compared with RM20.18 million in the preceding year, while cumulative revenue rose 85% to RM504.29 million from RM271.99 million.

SKP Resources Bhd, which saw its share price double since the beginning of 2015, still offers more upside potential, analysts said, anticipating a substantial jump in the group’s earnings for the financial year ending March 31, 2016 (FY16).

The main catalyst for the plastic parts and components manufacturer is the two contract wins from UK-based Dyson Ltd, for the manufacturing of cordless vacuum cleaners. The contracts are worth a combined RM1 billion per year, over five years.

Kenanga Research analyst Desmond Chong is optimistic on the two contracts and said they are an indicator of Dyson’s confidence in SKP’s capability.

“We are comforted by these new contract announcements as it signals Dyson’s confidence in SKP’s capability, which would boost its chances of securing other contracts in the near to medium term for other products.

“Beyond that, we also understand that the group has already involved in the development phase of new products that should take up another 20% to 30% capacity in the medium term, if all goes well,” said Chong.

Moreover, he noted that SKP could benefit from Dyson’s aggressive expansion plans, after the group announced an investment of £1.5 billion (RM9.54 billion) for the development of four new product ranges, for the launching of 100 new products in the next four years.

According to Bloomberg data, SKP’s share price jumped 103.13% in the past one year, despite the dampened domestic market. During the same period, the FBM KLCI saw a decline of 1.03%.

For the first half of FY16, net profit was 80% higher at RM36.32 million, compared with RM20.18 million in the preceding year, while cumulative revenue rose 85% to RM504.29 million from RM271.99 million.

http://www2.theedgemarkets.com/my/article/stock-picks-2016-skp-resources

http://www2.theedgemarkets.com