SYF RESOURCES BHD Right management, Right direction and ALL Right!

Introduction

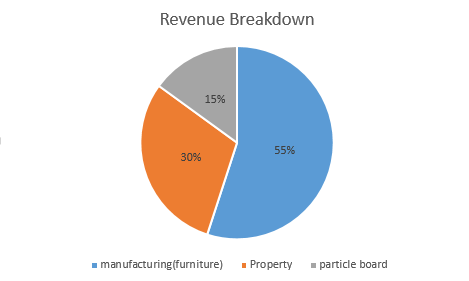

The Company’s business segments:

a. Furniture(dining set and bedroom set)

b. particle board

c. Property

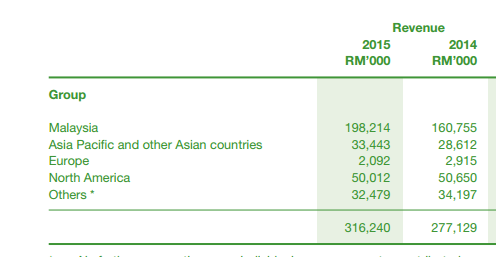

From the figures above, we can notice that Furniture remains the major

source of revenue, follow by property and board. Furniture sales is

mainly focused on domestic 2/3, export 1/3. The devaluation of Ringgit

didn't help much for this SYFy because I expect a slow down in sales

both domestic and export. Moreover, Syf furniture pattern is very old

fashion and lack of competitive advantage. I expect a 5%-10% gradually

decreases in manufacturing line for a continuition of 3 years. Overall,

for manufacturing business, it's consider 'stable' because this do not

affect much to the company since property devepment is growing well.

Besides, the Particle Board production is performaning very well in

recently years. Contribution from this segment has a double digits

growth, from Rm14,747m to Rm33,233. The new invested machines has

started its operation and expect a higher increase in production. This

help to offset the slowndown in furniture business, revenue remains

stable or maybe slightly increase in revenue.

Basically, the management and board of directors are noticed above the

difficulty of furniture business and they are doing a very good job

through diversification into other businesses(property and board).

On the other hand, housing market is slowing down after a few years of

bull run. But, this will not have impact to SYF for two reasons.

1. Kiara Plaze Semenyih a

combined of shoplots, Soho and service aprtment was fully sold out. This

is contributing significant revenue and profit to SYF quartely upon the

percentage of their vontruction finishing. This will easily help SYF

double up its FY2016 revenue for sure!

2. SYF is planning to start its

joint venture property development in sungai long in beginning of 2016.

Sg.Long has become a very hot area after UTAR Setapak moved to UTAR Sg.

Long. The number of students have increased double and rental cost

increased significantly. I expect SYF will also easy sell off all their

units once the project launch.

Since the manufacturing is remains stable, property deveopment segment

growing stronger, we could see skyrocketing quartely results in 2016. I

believe SYF still has more room to grow in 2016 and 2017.

Previously, SYF was a quiet counter, trading at low volume. But, this

stocks has started to gain attention from the public since December,

volume spike and stock prices trending higher and higher. SYF could be

one of the best performaning stock in 2016 support by its growth

prospect.

By comparison, I prefer warrant rather than mother because of its

higher % of return for each bit. Although SYF is a small cap counter,

but the risk for this stock is low. I suggest buy on weakness.

Article News :SYF (for reference)

I bought this stock one year ago. Since this is my first post, just show some of my holding stocks.

Wish all Happy New Year, and all the best in 2016!

SYF (7082) - SYF RESOURCES BHD, Transformation from Furniture to Property Development

http://klse.i3investor.com/blogs/citta/88956.jsp