LIIHEN is an integrated furniture manufacturer involved in a vast range

of wood-base activities under one roof. From UV Robotic finishing

product to Solid Dinettes, Buffets and Hutch to Bedroom set, Office

Furniture to Utility Shelves, Occasional to Shoe Rack and etcs[1].

LIIHEN is also located in Muar in the state of Johor, whereby HOMERIZ

is there also. To date, LIIHEN's products are well spread over 50

nations across the continental, such as America, Africa, Asia, Australia

and Europe. Through its subsidiaries, LIIHEN is engaged in the

manufacture of furniture (Lii Hen Furniture Sdn Bhd-100%, CT Haup Heng

Sdn Bhd-100%, Favourite Design Sdn Bhd-100%), manufacture office and

residential furniture (EF Furniture Sdn Bhd-100%), manufacturing of

furniture cmponents, processing and kiln drying of rubber wood and

timber (Mayteck Kilang kayu Dan Perabut Sdn Bhd-100%), property

investment (Kejora Juara Sdn Bhd-100%), investment holding (Lii Hen

Plantation Sdn Bhd-90%) and planting, cultivating, milling and dealing

in agriculture and forest products (PPL Plantations Sdn Bhd-80%)[2].

|

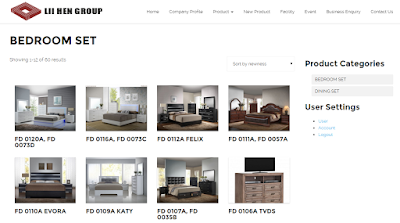

| LIIHEN products [1] |

After POHUAT released a quite-good result, i am looking at LIIHEN.

LIIHEN will be announcing the last quarter, Q4 result in February 2016.

That is why i am attracted to LIIHEN. If compared against its peers,

LIIHEN will be the last company to announce the Q4 result, and i do

think it is LIIHEN's time to shine. Why? Let's look at the analysis.

1) Fundamental Analysis:

|

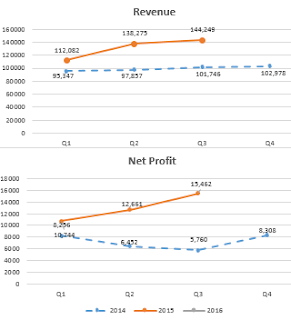

| Revenue and Net Profit |

LIIHEN is a net cash company with RM71,287k

of cash reserves, if converted to cash per share, it will be 0.3960.

When i compare the net cash per share with POHUAT, it is 0.3960 (LIIHEN)

vs 0.1755 (POHUAT). Both are net cash companies with major businesses in overseas. LIIHEN will be announcing its last Quarter Result in February 2016. Based on 2015 cumulative results, the net profit had actually overtaken 2014 whole year net profit by 35%.

(2014: RM28,776k vs 2015: RM38,867k), while for revenue, it is 2014:

RM397,928k vs 2015: RM394,606k. For sure 2015's revenue will easily

overtake 2014's revenue. Basically by simple mathematics, it just

require another RM3,322k to break 2014's revenue.

LIIHEN is a net cash company with RM71,287k

of cash reserves, if converted to cash per share, it will be 0.3960.

When i compare the net cash per share with POHUAT, it is 0.3960 (LIIHEN)

vs 0.1755 (POHUAT). Both are net cash companies with major businesses in overseas. LIIHEN will be announcing its last Quarter Result in February 2016. Based on 2015 cumulative results, the net profit had actually overtaken 2014 whole year net profit by 35%.

(2014: RM28,776k vs 2015: RM38,867k), while for revenue, it is 2014:

RM397,928k vs 2015: RM394,606k. For sure 2015's revenue will easily

overtake 2014's revenue. Basically by simple mathematics, it just

require another RM3,322k to break 2014's revenue.Let's look at the Chairman Statement in the Annual Report 2014. When comparing 2013 and 2014 revenue, the revenue is higher due to higher sales contribution from the bedding products, which made up to about 84% of the total revenue[2]. When i browse through its websites, one of LIIHEN's subsidiaries, Favourite Design Sdn Bhd is actually one of the leading furniture manufacturer in Malaysia for wooden bedroom sets comprising mixtures of polyurethane, faux marble and P.E coating[5]. Meanwhile, the sales of dining products remained constant and office products registered a negative growth. So my wild guess is this subsidiary is contributing a lot to LIIHEN's revenue in 2014.

|

| The bedding products from Favourite Design, LIIHEN's subsidiary[5] |

According to Mr Chairman, the weak market sentiments and escalation of production and labour costs are the challenges, however they continue to develop new, innovative and stylish design products to meet the needs and expectations of the market and to enhance the production facilities with automation, modern and state of the art machinery. For me personally, if you have better facilities or machines to help with the production, basically, one company can boost up the production. The management is committed to strengthen the Group's operational capabilities and efficiencies with better inventory and cost optimization measure.

|

| LIIHEN Production Sequences[1] |

|

| Revenue, Trade Receivables, Trade Payables and Cash[2] |

Next the Trade Payables. Trade Payables are debts that must be paid off within a given period of time[6]. Luckily for LIIHEN, the USD is only 1% weightage of the 2014 Trade Payables. Even though USD had increased 24%, but as totality the USD portion is very small. LIIHEN had increased their cash in USD by 51%, in which USD is the 52% of the total cash. The management is increasing the cash reserves in USD. When US had increased the interest rate by 0.25% and the USD is getting stronger, it might turn up to be hitting 2 birds with a stone. How important is the strengthening of USD/RM towards LIIHEN? In the foreign currency risk sensitivity analysis, if USD strengthened by 5%, the profit will be increased by RM2.1 mil. As we obtain from the Chairman Statement, the conversion used at the Annual Report is 3.24, by averaging the forex for the whole 2015, it is estimated around 3.90. From 3.24 to 3.90, the increment is around 20%! So we can anticipate around RM8.4 mil increment in the net profit due to forex gain. This will be an extra bonus.

On 20 October 2015, LIIHEN had a bonus issue and split share, which had

increased the number of shares to 180 million shares. In the recent

announcements, Mr Chua Lee Seng, the executive director had been selling

845,900 shares in the month of December alone, averagely at 2.70. He

had been selling 589,900 shares starting from July to October, averagely

at 6.3 before split and bonus. Why Mr Chua Lee Seng had been selling

all his shares throughout the year even though LIIHEN had been profiting

tremendously? The reason i could think is previously before the split

and the bonus, the number of shares available is only 60 million shares,

and mostly are held by the directors. So in order for LIIHEN to be more

active, Mr Chua had been selling his shares so that it is more available in the open market.

When there are more shares in the market, it will benefit the retailers

like you and me to participate in LIIHEN. Of course, this is just my

assumption. If you have any ideas, you can comment on this statement. Another point to note here, Mr Koon Yew Yin

had been emerging in the top 30 shareholders in the Annual Report 2014.

As a value investor, i believe He saw something in LIIHEN in which we

can follow his footsteps.

2) Technical Analysis:

|

| LIIHEN daily chart |

LIIHEN had been in uptrend until a gap up followed by a shooting star in

the mid of December. Since then, LIIHEN dropped and now in sideways, hovering around 2.7 to 2.8. I had drawn a support at 2.60 and 2 resistances at 2.78 and 3.00

respectively. Notice i draw a grey eclipse in the chart? It is the area

when Mr Chua are disposing his shares but the price did not fall below

2.60, if yes, it rebounded very fast. By performing a risk to reward

ratio, the RRR is actually very ideal. Based on the closing on 6 January

2016, 2.73. We can cut loss if the price falls below the support, and

it might go up to 3.00. So the RRR is around 1:3, 1 portion of risk vs 3 portion of rewards.

The volumes are starting to pick up these few days, with the MACD

turning into bullish. If LIIHEN stock price reached past 2.78 and 3.00,

then sky is the limit. It will form an uptrend channel. And i strongly

believe the stock price of 3.00 is reachable as their Q4 Result will be

announced in February 2016.

3) Projection Analysis:

Now, let's try to project LIIHEN's price. I will have 2 case studies. Again, the projection is just for the comfort level.

Case 1: Assuming the Worst Case Scenario

Let's assume that the net profit for Q4 is the same as Q1, which is RM10,744k, the projected EPS for Q4 will be 0.0597. The net profit for the whole year will be RM49,611k divided by the number of shares 180,000k shares, totaling up to the EPS of 0.2756.

Let's assume the PE = 10, therefore the Price = 0.2756 x 10 = 2.75

With the current range between 2.7 to 2.73, it is actually lagging behind its supposed value. And again, this is considering the Q4's net profit is the same as Q1, which is the lowest of the cumulative quarters. This is the safest case and most low risk case scenario. (By the way, i would like to thank my friend, Mr Huat for sharing his Huat Analysis & his assumptions of taking the net profit of Q4 = Q1, which is the lowest net profit of all. Terima kasih byk byk, my fren~)

Case 2: Assuming Annualized Net Profit

Let's assume i annualized the net profit for the whole year. The net profit for 3 Quarters is RM38,867, divided by 3 Quarters x 4 Quarters, the annualized net profit is RM51,823k. In other words, the net profit for Q4 is projected at least RM12,956k. And the EPS for 2015 will be 0.2879.

Let's assume the PE = 10, therefore the Price = 0.2879 x 10 = 2.88

Again, this projection proves that the current price of LIIHEN (below 2.75) is actually lagging behind. Do take note the annualized net profit is taken into consideration, and i do expect the net profit for Q4 is to be at least RM12,956k or more than that. If it is more than RM12,956k, then i will say that the current price is lagging more behind.

I will perform a similar projection analysis as i had done to POHUAT. LIIHEN is now lacking of Q4 result, but we already know the exchange rate for the whole year for 2015. As mentioned in the Annual Report 2014, the management are using the exchange rate of USD/RM is 3.24, and for the year 2015, the exchange rate is approximately 3.90.

In 2014, when USD/RM is 3.24, the realized foreign exchange gain is

RM5,318k. For the year 2015, when the USD/RM is 3.90, as i had mentioned

earlier, i projected around RM8.4 mil of foreign exchange gain. However

when i check through the Q3 Report, LIIHEN had actually had realized

the foreign exchange gain of RM7,035k, which is higher than what we had

calculated. Therefore definitely 2015's foreign exchange gain is higher than 2014's.

Let's assume that the net profit for Q4 is the same as Q1, which is RM10,744k, the projected EPS for Q4 will be 0.0597. The net profit for the whole year will be RM49,611k divided by the number of shares 180,000k shares, totaling up to the EPS of 0.2756.

Let's assume the PE = 10, therefore the Price = 0.2756 x 10 = 2.75

With the current range between 2.7 to 2.73, it is actually lagging behind its supposed value. And again, this is considering the Q4's net profit is the same as Q1, which is the lowest of the cumulative quarters. This is the safest case and most low risk case scenario. (By the way, i would like to thank my friend, Mr Huat for sharing his Huat Analysis & his assumptions of taking the net profit of Q4 = Q1, which is the lowest net profit of all. Terima kasih byk byk, my fren~)

Case 2: Assuming Annualized Net Profit

Let's assume i annualized the net profit for the whole year. The net profit for 3 Quarters is RM38,867, divided by 3 Quarters x 4 Quarters, the annualized net profit is RM51,823k. In other words, the net profit for Q4 is projected at least RM12,956k. And the EPS for 2015 will be 0.2879.

Let's assume the PE = 10, therefore the Price = 0.2879 x 10 = 2.88

Again, this projection proves that the current price of LIIHEN (below 2.75) is actually lagging behind. Do take note the annualized net profit is taken into consideration, and i do expect the net profit for Q4 is to be at least RM12,956k or more than that. If it is more than RM12,956k, then i will say that the current price is lagging more behind.

I will perform a similar projection analysis as i had done to POHUAT. LIIHEN is now lacking of Q4 result, but we already know the exchange rate for the whole year for 2015. As mentioned in the Annual Report 2014, the management are using the exchange rate of USD/RM is 3.24, and for the year 2015, the exchange rate is approximately 3.90.

|

| Extracted from Annual Report 2014 page 104[2] |

|

| Extracted from Q3 2015 [3] |

Summary:

LIIHEN is an export oriented furniture company, adhered to the current

themeplay. Personally, i like the counters that the cummulative net

profit had already surpassed last year's whole year. Just like how i

identify ESCERAM, OCNCASH and POHUAT in 2015. Now in the new year of

2016, i will also continue to search these hidden potential counters.

And LIIHEN is one of those counters that i will strongly go for due to:

- Revenue and net profit had been

increasing throughout the year. The cumulative of 3 Quarters of Net

Profit had surpassed 2014's Net Profit.

- Will be announcing Q4 results in February 2016.

- Net cash company with RM71,287k and net

cash per share of 0.3960. In the Annual Report 2014, USD covers 52% of

the total cash. If USD strengthened by 5%, the profit will be increased

by RM2.1 mil. From 3.24 to 3.9, the increment is around 20% and we can

anticipate around RM8.4 mil increment due to forex gain.

- Trade Receivables in USD had increased 13% yoy and trade payables in USD is only 1% weightage of 2014 Trade Payables.

- Giving out dividends every Quarter, with Dividend Yield of 3.15%.

- Major business in overseas as America's

market is 78% as stated in the Q3 Quarter Report, which is favouring to

USD strenghthening (4.4066 as the time of writing)

- LIIHEN is enhancing the production

facilities with automation, modern and state of the art machinery to

boost up the production to meet the increasing demands.

- LIIHEN had a bonus issue and split

share, which increased the number of shares to 180 million shares. Mr

Chua Lee Seng, the executive director had been selling his shares. In my

opinion, maybe he wants to make sure that there are more shares

available in the open market. This should not be having any impact in

the long term. Mr Koon Yew Yin, our super value investor had also

emerged in the top 30 shareholders.

- Support at 2.60 and 2 immediate resistances at 2.78 and 3.00 respectively. If breach 3.00, then sky is the limit.

- Had a favourable RRR of 1:3. 1 portion

of risk vs 3 portion of rewards. Cut loss at 2.60, and take profit if it

hit your target price.

- By assuming the annualized net profit

with the PE of 10, the price for LIIHEN should be around 2.88. The

current price of LIIHEN (ranging from 2.67 to 2.75) is actually lagging

behind its supposed value.

- Respect the cut loss point very much

during these volatile weeks. Watchout for China markets also. When they

sneeze, the whole world will be in red. Therefore, do respect the cut

loss point very very much.

LIIHEN's finally time to shine? Do you agree with me?

Gainvestor short term TP: 3.00

Gainvestor long term TP: 5.00

Gainvestor long term TP: 5.00

Let's Ride the Wind and Gainvest

Gainvestor 10sai

7 January 2016

2.25pm

Sources:

[1]: http://www.liihenfurniture.com/index.php

[2]: Annual Report 2014

[2]: Annual Report 2014

[3]: Q3 2015

[4]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2015

[5]: http://favouritedesign.com.my/company-profile/

[6]: http://www.investopedia.com/

[7]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2013

[4]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2015

[5]: http://favouritedesign.com.my/company-profile/

[6]: http://www.investopedia.com/

[7]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2013

http://gainvestor10sai.blogspot.my/2016/01/liihen-time-to-shine.html