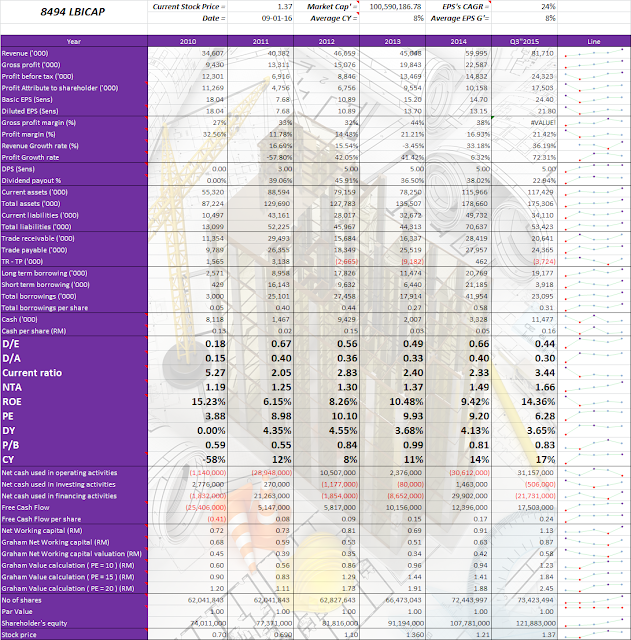

8494 LBICAP

Company

Overview

·

Three

business activity & sales %:

i.

Management

services - 3.74%

ii.

Development

of properties - 96.03%

iii.

Trading

of rubber product - 0.23%

·

Company

website: http://www.lbi-capital.com.my/

Personal

Comment

·

LBICAP

is a low profile company; its trading of stock volume is low.

·

It

hit lot of criteria to pick a good fundamental company, that is:

i.

PE

low with 5.

ii.

High

ROE with 16.67%.

iii.

Acceptable

DY with 3.56%.

iv.

High

NTA with RM 1.66.

v.

V.

ROA with 10%.

·

But

cash flow is the weakness of LBICAP, historical cash flow in category operating

and financing activities giving bad result.

·

After

deduct total bank borrowing from cash holding, LBICAP is a net negative cash

company.

·

LBICAP

should solve its cash problem to be a healthy cash company.

·

On

the hand, free cash flow of LBICAP is showing healthy and it is increasing in

yearly.

·

From

earning valuation model, it giving intrinsic value RM 2.02.

·

The

catalyst needed by LBICAP is new property development project.

·

In

Greenblatt's Magic Formula, earning yield and return on capital giving 11% and

12%% respectively.

Additional

Information

·

Property

development is the source of revenue and revenue of LBICAP. Current LBICAP's

townhouse project Desa Saujana 2 at side of completion period.

·

Second

phase of industrial turnkey development I-Hub@Puchong expected launched this

year.

·

Project

in Section 14, PJ which h comprising 11 units bungalow expected launched by

Q3''2015.

·

LBICAP

also planning to redevelop earlier wet market plan into 24 units’ double storey

shop office.

·

LBICAP’s

bank borrowing need cleared soon because the maturity within one and two years

amounted to RM 34,143,262.

·

There

is uptrend on Revenue, Net profit and ROE since year 2011.

·

Dividend

is decreasing since year 2012 but the DY is maintained above 3%.

·

Here

a latest news showing LBICAP going disposed 4 lands with RM 50 million,

management going use this cash by:

i.

RM

3.5 million clears bank borrowing.

ii.

RM

25 million acquires other land.

iii.

RM

18 million used on working capital.

iv.

Amount

left charged by RPGT and expenses.

·

Director's

active transaction on acquire LBICAP shares and warrant -

http://www.klse.my/stock/insider/director/all/8494.jsp#stockDetailDiv

·

LBICAP's

active shares buy back activity in year 2015 -

http://www.klse.my/stock/insider/company/shareBuyback/8494.jsp#stockDetailDiv

·

LBICAP's

last buy back share is year 2010, and next is year 2015, is it management think

the current price of LBICAP is undervalued?

本文只供参考。共勉之。

http://investmentkai.blogspot.my/2016/01/8494-lbicap.html