Recently, my followers ask me what kang tou (“Lubang”) can buy

recently? But mostly already gone up like FFHB, TECFAST, and RGB. Then,

I told them,” I still collect Keinhin as their price still cheap to

me”. Then question start coming. (“All time high still can chase? Buy

high can sell higher keh?”)

Let me answer few questions here:

1. Have Keinhin financial result keeps improving? Got growth or not?

2. Have Keinhin successful in their expansion in Vietnam?

3. How high Keinhin can go? Or another words, what is your TP?

Kein Hing International Berhad, one of the growth stocks that I think that will shine in Year 2016. Year of 2016 will be a new chapter of life for Malaysia as our ringgit still remains weak. Plenty supply of crude oil will cause uncertainty in global oil price. Therefore, stock selection must be wisely indeed.

This stock again triggers my watch list when posted well for the financial year ending 30 April 2016. Keinhin has operations in Malaysia, Vietnam, Japan, Europe, Hong Kong, Thailand, and internationally. Keinhin applied organic growth strategy whereby the process of business expansion by increased output, customer base expansion.

The company engages in sheet metal forming, precision machining, components assembly, and designing and fabricating tools for automotive, electronic components, home appliances, and audio-visual equipment industries. The company is also involved in the precision machining of electronics and electrical industries components. In addition, it manufactures, distributes, trades in, and sells gas appliances under the ZENNE brand name (Adopted from “Bursa Market Place”).

Why Keinhin? (Adopted from 2nd Quarterly Financial Report 2015)

1. Improvement demand domestically and internationally

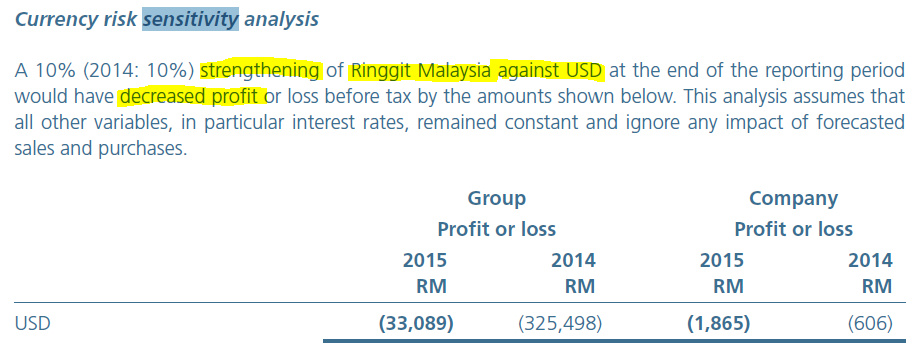

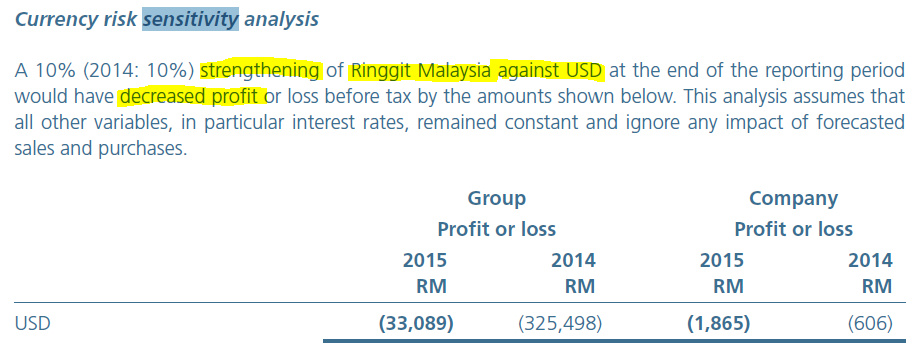

2. Benefit from weaker Ringgit (Adopted from Annual Report Keinhin 2015)

3. Future prospect

Management has been collecting the stocks and they never dispose any share as to current year to date. This represents the confidence level of their management.

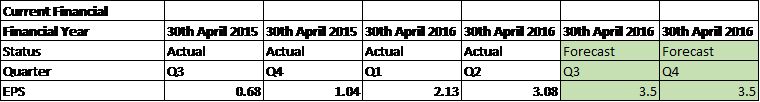

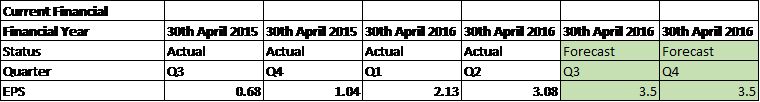

Let’s us forecast Keinhin the coming next quarter with the real earning per share with 3.5 cents in Q3 and Q4.

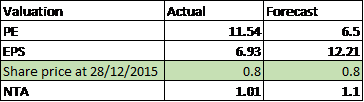

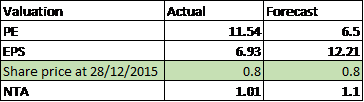

This means that you are buying a future of Keinhin with current share price RM0.80 with PE as low of 6.5 provided Keinhin continuously performed well in coming, not to mentioned, dividend as well.

Net Tangible Asset of Keinhin of 2nd quarter worth more than RM1. Therefore, should Keinhin deserve a share price by just having RM0.80 only? You decide…

TP RM1 (Invest on your own risk)

KEINHIN (7199) - KEIN HING INTERNATIONAL BHD (KEINHIN, 7199) (You In Already?)

http://klse.i3investor.com/blogs/KEINHIN/88766.jsp

Let me answer few questions here:

1. Have Keinhin financial result keeps improving? Got growth or not?

2. Have Keinhin successful in their expansion in Vietnam?

3. How high Keinhin can go? Or another words, what is your TP?

Kein Hing International Berhad, one of the growth stocks that I think that will shine in Year 2016. Year of 2016 will be a new chapter of life for Malaysia as our ringgit still remains weak. Plenty supply of crude oil will cause uncertainty in global oil price. Therefore, stock selection must be wisely indeed.

This stock again triggers my watch list when posted well for the financial year ending 30 April 2016. Keinhin has operations in Malaysia, Vietnam, Japan, Europe, Hong Kong, Thailand, and internationally. Keinhin applied organic growth strategy whereby the process of business expansion by increased output, customer base expansion.

The company engages in sheet metal forming, precision machining, components assembly, and designing and fabricating tools for automotive, electronic components, home appliances, and audio-visual equipment industries. The company is also involved in the precision machining of electronics and electrical industries components. In addition, it manufactures, distributes, trades in, and sells gas appliances under the ZENNE brand name (Adopted from “Bursa Market Place”).

Why Keinhin? (Adopted from 2nd Quarterly Financial Report 2015)

1. Improvement demand domestically and internationally

2. Benefit from weaker Ringgit (Adopted from Annual Report Keinhin 2015)

3. Future prospect

Management has been collecting the stocks and they never dispose any share as to current year to date. This represents the confidence level of their management.

Let’s us forecast Keinhin the coming next quarter with the real earning per share with 3.5 cents in Q3 and Q4.

This means that you are buying a future of Keinhin with current share price RM0.80 with PE as low of 6.5 provided Keinhin continuously performed well in coming, not to mentioned, dividend as well.

Net Tangible Asset of Keinhin of 2nd quarter worth more than RM1. Therefore, should Keinhin deserve a share price by just having RM0.80 only? You decide…

TP RM1 (Invest on your own risk)

KEINHIN (7199) - KEIN HING INTERNATIONAL BHD (KEINHIN, 7199) (You In Already?)

http://klse.i3investor.com/blogs/KEINHIN/88766.jsp