PADINI (7052) - On Padini's new tactic

Introduction

My first formal suit was Padini, way back to my Year 1 in college. It was bought in JB City Square, a prime strategic location connecting JB and Singapore's check point. Sadly that outlet has been closed (not relocated).

That was my first impression that things have gone wrong with Padini.

Padini adopted a new tactice

Prior to GST implementation, I and my family members patroned Padini to collect darn CHEAP apparels (as low as RM16 for a formal shirt). These are old stocks. The sales aimed to reduce its inventory.

Nevertheless, apparel retailing is increasingly competitive. Uniqlo and H&M remain consistent with their marketing and positioning models in line with their international standards. In countering these international apparel brands, Padini has adopted a different tactic: sell cheap for acceptable quality.

Is that value for money? This point is debatable. I leave that to you.

What matters most, to investors and Padini management, is whether that new tactic is able to return Padini to new heights?

Padini falls in a vicious cycle?

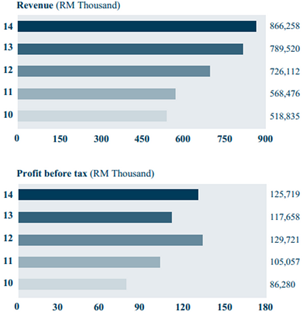

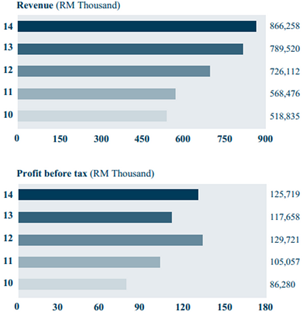

Inferring from the charts below, Padini should have the ability to recover from earnings slump.

But, looking forward, Padini may have fallen in a vicious cycle. The vicious cycle refers to a bad situation feeds on itself to make it even worse.

Why did I say so?

In a common retail example, same store sales are falling. In response, management steps up the intensity of promotions. This has a temporary impact. However, whenever the promotions end, sales return to free fall, faster than before. Management accelerates promotions again, until operations cannot handle it and the suppy chain breaks down.

Evidences are available showing Padini have done and are implementing some of the abovementioned practices, i.e. promotion intensification, shifting production plant to China, and cheapening products.

In fact, Padini's reinvestment embarks on opening new outlets and cheapening the products, leading to even more investment withdrawn to maintain short-term profits. Hence, maintaining business efficiency is not the top priority.

Unfortunately, these moves do not seem to work. Padini, in the eyes of customers (at least me and my family), have lost its unique position. Cluttering it up with price-based promotions just reinforces this perception.

Quality is compromised: we find hole(s) in my Padini full cotton shirts and pants after few washes in a front load washing machine.

To me, as an investor, Padini's short term solution just made the fundamental problem worse.

The latest quarterly report suggests that Padini's new tactic is a poor one. Coming quarters will affirm whether it yields weak performance.

http://klse.i3investor.com/blogs/netnets/75055.jsp

Introduction

My first formal suit was Padini, way back to my Year 1 in college. It was bought in JB City Square, a prime strategic location connecting JB and Singapore's check point. Sadly that outlet has been closed (not relocated).

That was my first impression that things have gone wrong with Padini.

Padini adopted a new tactice

Prior to GST implementation, I and my family members patroned Padini to collect darn CHEAP apparels (as low as RM16 for a formal shirt). These are old stocks. The sales aimed to reduce its inventory.

Nevertheless, apparel retailing is increasingly competitive. Uniqlo and H&M remain consistent with their marketing and positioning models in line with their international standards. In countering these international apparel brands, Padini has adopted a different tactic: sell cheap for acceptable quality.

Is that value for money? This point is debatable. I leave that to you.

What matters most, to investors and Padini management, is whether that new tactic is able to return Padini to new heights?

Padini falls in a vicious cycle?

Inferring from the charts below, Padini should have the ability to recover from earnings slump.

But, looking forward, Padini may have fallen in a vicious cycle. The vicious cycle refers to a bad situation feeds on itself to make it even worse.

Why did I say so?

In a common retail example, same store sales are falling. In response, management steps up the intensity of promotions. This has a temporary impact. However, whenever the promotions end, sales return to free fall, faster than before. Management accelerates promotions again, until operations cannot handle it and the suppy chain breaks down.

Evidences are available showing Padini have done and are implementing some of the abovementioned practices, i.e. promotion intensification, shifting production plant to China, and cheapening products.

In fact, Padini's reinvestment embarks on opening new outlets and cheapening the products, leading to even more investment withdrawn to maintain short-term profits. Hence, maintaining business efficiency is not the top priority.

Unfortunately, these moves do not seem to work. Padini, in the eyes of customers (at least me and my family), have lost its unique position. Cluttering it up with price-based promotions just reinforces this perception.

Quality is compromised: we find hole(s) in my Padini full cotton shirts and pants after few washes in a front load washing machine.

To me, as an investor, Padini's short term solution just made the fundamental problem worse.

The latest quarterly report suggests that Padini's new tactic is a poor one. Coming quarters will affirm whether it yields weak performance.

http://klse.i3investor.com/blogs/netnets/75055.jsp