LTKM (7085) - The Omitted Egg

March 12, 2015

Poultry and layers farms have been the current theme-play due to higher selling price of eggs and chicken as well as falling feed price. With some of the industry players' stock (e.g. QL, TeoSeng, CAB & PW) have been under coverage by sell-side analysts, I tried to research on company that is currently not under coverage. I have looked into LTKM, a long-time layers farm company listed in Bursa Malaysia since 2000. It is the 5th largest egg producer in Malaysia with daily production capacity at 1.8mil eggs.

1.0 Summary

LTKM

is a pure-play on the egg production story with 98% of its sales comes

from layers business. LTKM recently reported a strong financial report

with 9MFY15's operating profit margin at 23%, which is unprecedented in

the past 10 years due to (i)higher selling price of eggs to Singapore

(LTKM exports over 40% of the egg production to Singapore and Hong Kong)

(ii) declining feed price in the past 2 years.

Looking

forward, I expect LTKM to sustain the current profitability in FY2016

as (i) feed price is expected to stay low and stable and (ii) eggs' ASP

is expected to remain high in CY2015.

After

FY2016, Revenue and PBT are expected to decline slowly due to (i)

gradual recovery of feed price and (ii) normalized of eggs' ASP (iii)

lack of capacity expansion plan.

Overall,

I still see upside potential of the stock with SOP TP at at RM7.55 (14%

upside) as (i) Feed price increase will be gradual and stable in the

next 5 years, which do not hurt LTKM's margin significantly (ii) ASP,

though fluctuating, is generally rising in the long-term. (iii) Recent

market's focus on poultry-theme play due to the former 2 factors as well

as investors shift to recession-proof consumer-sector amid concern over

GST and slower economic growth will dampen consumer spending.

However,

as poultry business is cyclical in natural, I do not advice long-term

investment in the stock but rather give a Hold or Short-Term Buy rating

to the call. Disclaimer: This is just an advice, not a investment recommendation.

2.0 Background

LTKM

listed in Bursa Malaysia in year 2000 and is tightly-held by its

director, Datuk Tan Kok with direct and indirect shareholding of 65% of

the company. (Hence, free-float available to the market is not much,

that is also why it is not covered by any sell-side.) LTKM's egg

production capacity is at 1.4mil eggs per day since 2011, up only 40%

from 1.0mil egg in 2000. LTKM is the 5th largest egg producer by egg

production capacity.

Layers

farm is a cyclical business, LTKM has seen its Net Margin swinging in

the range of 5.9%-18.2% in the past 8 years. The 2 major factors

determined the ups and downs of the company's profitability are (i)

Average Selling Price (ASP) of the eggs, which depend largely on the

supply condition of the market as demand is stable and predictable as

well as inelastic to price change (ii) and feed price. Cost of layers'

feeding take up 55-65% of the total cost of layer farms. The main

component of the feed are soybean meal and corn, the price of which,

like other commodities, have been fluctuating in the last decades and

the price of the commodities determined largely the profitability of the

business. I have done a regression analysis on the effect of change in

feed price to LTKM's Gross Margin. It shows that the later is 90%

explained by the former in the past 8 years, which make layer farm

business behave like like a commodity business, just the opposite way.

Since

2008, LTKM has ventured into other non-related business and now,

besides the core poultry business, they are also in the business of sand

mining and extraction as well as property development. In 2009, they

have ventured into glass-processing business but have in 2013

discountinued the business with a net loss of RM12.9mil registered in

FY2013. Besides that, they also currently own RM40.5m of investment

properties and RM33.4mil of investment securities, which are

cumulatively 35% of the 3Q2015's total asset.

Sand

mining business contributed insignificantly to the group Revenue and

PBT. Although property development contributed 16-26% of PBT in the past

2 years, it is not expected to have significant contribution in FY15 as

there are no development in progress currently.

LTKM

is a company where the key shareholders/directors have most of the say

on the company direction. Dividend payout have been meanly low at

average of 28% of the Net Profit. This may probably due to cyclical

natural of the business and Cash Flow, hence, and the management prefer

to hoard cash for raining day. Non-core asset and net cash position now

contributed 45% and 54% of the total asset and total equity

respectively.

3.0 Key Industry Development

LTKM's Poultry business GPM have been rising in the past 8 quarters from 15% in Q4FY13 to 29% in Q3FY15 mainly due to:

i) Rising average selling price (ASP) of eggs in Singapore

In

2014, ASP of eggs have gone up over 10% in the second half of the year

after 3 farms in Malaysia were suspended from selling eggs to Singapore

by Agri-Food and Veterinary Authority (AVA), Singapore. The suspension

was due to eggs from the farms were found to contain Salmonella

enteritidis, a bacterium that causes food poisoning. The 3 farms

accounting for less than 8% of Singapore total supply. Currently, 20

Malaysian farms are approved to export eggs to Singapore by AVA, down

from 23 previously. LTKM exports over 40% of their eggs to Singapore and

Hong Kong. With the higher average selling price (ASP), LTKM's Poultry

GPM rise from 23% in 4QFY14 to 29%, which is around the period of the

incident. Beside higher ASP in SGD, Gross Margin is also partially

benefited from the strengthening of SGD of about 5% in the past 6

months.

(Link to approved list: http://www.ava.gov.sg/docs/default-source/tools-and-resources/resources-for-businesses/my_layerfarmy150126.pdf)

Undersupply

of egg in Singapore do not expected to last forever as the invisible

hand will work for itself with new source of supply will eventually

enter the market to take a share of the economic benefit. Hence, egg

price will eventually normalized in Singapore. Teo Seng have already

planned to increase their daily capacity by 400k eggs annually in the

next 5 years. Will the new capacity get approved from AVA to export to

Singapore? Though one of their farms just get suspended last year.

Side

story - From game theory point of view, it would be best if all

producers do not increase their supply to Singapore market to keep the

eggs' price and their margin high. It is called the Socially Optimal

Situation(SOS) where all players get to earn more by selling the same

amount of eggs. But this SOS will not achieved as players will start to

increase supply in concern of others will do it beforehand. Game

theorist will predict supply will eventually rise to equilibrium.

Even

though ASP in Singapore may normalized eventually, generally ASP of egg

in Peninsular have been rising at 5.6% CAGR in 2007-2013, much faster

that the inflation rate of 1-3%.

ii) Lower feed price

Beginning

in 2013, the price of feed have been declining due to significant

increase of supply and stock of soybean and corn internationally. The

surge in the commodities' stocks are due to increased planting, higher

yield as well as overestimation of China's demand.

With

the bless of cheap feed, LTKM's Cost of Inventories(COI), which is part

of the the cost of goods sold, fall from the high of 68% of the sales

in FY2013 to 58% in FY2014, which is a 10% cost saving. COI is expected

to be lower in FY2015 at projected 53% of the sales. Nevertheless, the

benefit of fall in feed price is partially offset by the weakening RM.

LTKM's payable in USD is insignificant, its purchase of feed should be

done with local suppliers. Although hike in feed price due to currency

exchange rate will still be mostly bared by LTKM, but it will be more

manageable and less uncertain.

|

| Source: World Bank; Annual Average Feed Mixture Price represented by 72% Corn/28% Soybean Meal price in RM per Metric Ton. |

|

| Source: World Bank |

4.0 Industry Outlook

Due

to record high of plantings and yield in US as well as over-planting in

China caused by over optimistic projection of China's economic growth,

supply surge faster than demand caused stocks-to-use ratio to rise

significantly in the past 2 years. This cause the slump of feed price in

the past 2 years. In the next 5 years until 2020, stocks-to-use ratio

of corn(maize) and soybean are expected to declined steadily, yet still

generally higher that the figure 2 years ago. Hence, price of corn and

soybean is expected to remain low stable and low in the next few years,

which is a very good news for poultry farms. Although feed price is

expected to bias upward in the near future as planters start to reduce

planting and stocks is declining, the rise is expected to be mild and

stable with the still-high stocks-to-use ratio. The recent decline in

crude oil price and slow global economic growth should also help to keep

feed price lower in the coming years.

LTKM

currently has about 10% of the market share by production capacity and

no production expansion plan. The production volume is expected to be

flat in the future and topline is mainly depends on the ASP of eggs.

LTKM's competitor, Teo Seng (Malaysia third largest producer) is

planning to expand its production capacity by 400,000 eggs per day

annually for the next 5 years. Capacity is planned to grow to 5.1mil

eggs from the current 3.1mil in 5 years time and increasing its market

share. With Teo Seng's daily production expansion at 400,000 eggs

annually, which approximate the average annual rise of output in the

past decades, LTKM and other players have no much room for expansion (in

egg production) as doing so may risk oversupply. I do not foresee high

capex in the coming years of LTKM and production should remain flat.

5.0 Financial

|

| Other ratio not available in the common size analysis above |

6.0 Current Market Valuation

7.0 Projection & Valuation

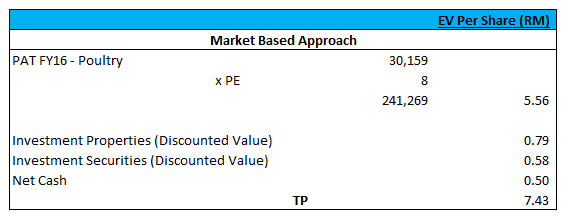

My

TP is based on SOP/DCF approach. However, market/PE approach is shown

here for comparison. Poultry business valued at 8x FY16 Earning which is

lower than 13X given by AmResarch to TeoSeng and 9x given to CAB by

Kenanga as LTKM do not have expansion plan compared to these 2

competitors. However, 8x PE is reasonable as LTKM's ROE and PAT Margin

ranked second among the others players. The discounted value of

Investment Properties/Securities is as shown in SOP valuation above.

PE-based TP of RM7.43 coincide with my TP (1.6% variance).

8.0 Risk & Mitigation

i. Any

outbreak of birdflu or other type of virus will cause lost of sales,

inventories and biological asset impairment loss and reputation damage

to LTKM

ii. Suspension by AVA from export eggs into Singapore due to detection of Salmonella enteritidis bacteria will cause lost in revenue and drop in profit margin

LTKM have bio-security system for the farm in addition to control measures put in place by relevant authorities to minimize the risk of contamination. With the current high stock and supply condition for feed commodities as well as sluggish global growth, supply and demand is expected to remain stable except for factors due to weather, which is getting more volatile in the recent years.

9.0 Conclusion

The

stock will still have room for appreciation given recent market's

attention on poultry play. Among the competitors, LTKM is one of the

cheapest and most profitable players. However, the upside is capped by

its limited growth potential. My TP is based on SOP/DCF and at RM7.55

suggesting a 14% upside potential. However, investors/traders should be

caution as the stock have appreciated significantly in the past 1 years,

any shift in stock market sentiment will give reason to the existing

shareholders to take profit. The stock also have high liquidity risk due

to the low free float. My advice is to keep holding this stock if you

have already entered earlier. If not, you can look at CAB and Teo Seng

for better growth prospect. Besides the ASP rise and lower feed price,

poultry stocks are recently in favor as investors look at

recession-proof consumer-setor amid concern on GST and slower economy

growth. Investors' sentiment on consumer stocks have been dampen due to

these due to expected lower consumer spending caused by these 2 factors,

but poultry stocks offer a defensive play as eggs and poultry

consumption have been resilient in the past, regardless of the economic

condition.

10.0 Appendices

http://bullandbearresearch.blogspot.com